Frankly speaking, I have been putting off writing this post for a while since I was re-structuring my portfolio a bit. So, in this analysis, you'll find that I have a sizeable amount of funds that are in cash, which is quite unlike me. I also obtained control over my dad's portfolio and that is no easy work to handle - quite a bit of restructuring required in his portfolio and that's kept be a bit occupied.

Well, let's start off with the portfolio analysis and then move on to the equities section.

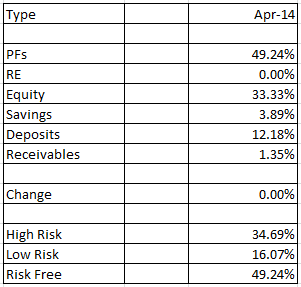

Figure 1: Portfolio Allocation

- The PFs continue to decline, as expected and desired. At this point of time, there is no need to invest heavily into PFs. Considering the equity market conditions (mostly bullish with the prospect of a another collapse in the future), a buffer amount needs to be maintained in PFs while being ready to exit the equity markets at the first sign of a collapse.

- The Real Estate property continues to be paid for on a monthly basis, this will increase gradually and there is no rush to pay off the house loan at present. On another note, the market rate of the property is about 20% above its buy price, about 20 months since purchase. This was the case a couple of months back and I am quite glad with the progress so far.

- Equity allocation continues to increase at a decent rate. I'd like to be invested more in this but the markets seem to be quite overvalued at present. The global and Indian economies aren't faring as good as one would like and that is increasing the risk associated with this investment at this point of time. Having seen the worst of one recession, would like to take appropriate precautions if another one occurs :)

- Savings have reduced slightly since I deployed some funds to equities. Well, that's what they are for, so no harm done. Will increase this gradually and deploy appropriately when sufficiently accumulated.

In my previous posts, I had placed RE under the Risk Free category and that seems wrong to me. Regardless of how sure one is, Real Estate investments are not risk free. There is always a possibility of that investment value reducing. So, I have moved it to the Low Risk category. Although it is comforting to see such a huge portion of the investment in Risk Free, I'd like to increase the High Risk component so that the percentage allocation changes. At a young age, one should take advantage of the High Risk investments to generate higher returns. The Risk Free investment options should ideally be used once one is riddled with responsibilities or has to retire.

Moving on, let's take a look at the Equity portfolio now.

Figure 2: Equity Portfolio

There have been quite a few changes this time around and a few more to come. It is the quarterly results season and I have been deciding on some of the stocks in my portfolio with regards to the same, as well as future prospects. Besides, the budget for this year will be announced soon and that will be another key indicator to look forward to, from equity selection perspective.

- Ashok Leyland, an automotive company, is one of the star performers at the moment. I believe this stock has yet to unlock its value and I expect this to be in my portfolio as long as good market conditions prevail.

- Fluidomat is a recent acquisition. I don't really have much to mention on this one. If the engineering/manufacturing sector does well and the government comes up with the much needed reforms, this stock will do well.

- Firstsource Solutions had a very nice run-up and I exited at its peak. Since then, it has corrected a lot and is quite close to my buy price. I have purchased this again, but on my dad's portfolio.

- Gabriel, the stock that has more than doubled since my purchase, is an auto ancillaries company and its performance is tied to the market conditions/auto sector companies.

- Gayatri Projects, a construction company based in Andhra Pradesh and executing projects in that area, has been stagnant for quite some time. Hence, I reduced exposure to this stock to make other purchases. When it shows signs of life again, will increase exposure.

- ITC, a tobacco company, that has been trying to diversify for quite some time now, by funding its loss making ventures using the profits from its cigarette business, has been hurting the shareholder wealth considerably. Hence, I have sold this stock. With the government's anti-tobacco stand, its prospects don't look too good in the future, unless it gets its act together.

- Larsen and Toubro, probably the largest engineering company in the country, has started moving up again. Its performance is directly tied to the performance of the economy. A boost in the engineering sector and some reforms would propel this stock immensely.

- Reliance Industries, I bought this just before the oil price dropped from $100 to $50. That has really hurt this stock. But I am at present unable to exit it for two reasons. I believe the oil prices are unnaturally low and will have to come up. The stock should rise up again when that happens. Also, the unlocking of the value of its telecom company, Reliance Jio should offer good returns as well. Only time will tell.

- SBI, largest public sector bank in the country, has been doing well since it started fixing its NPA since 2 years ago. Hopefully, if it continues on the same path, it will be a real money maker.

- Selan, another oil company, primarily focusing on exploration, will do well once oil prices rebound.

- Sun Pharma, a good stabilizer in the portfolio, is also performing quite well and has risen quite a bit since my purchase.

- Zee Learn, wasn't doing well and hence I exited the stock with minor losses. A stock in the education sector is required but this one isn't up to it yet.

I still have some deployable funds and am waiting for the right opportunity to use those. Currently, the market is at an all-time high and it just doesn't feel like the right time to use up my funds. Besides, the situation all over the globe isn't all that rosy and a crisis can appear at any time.

The portfolio has out-performed the index as always, and by a significant margin too. Not factoring in the added funds, there is a stark difference of 7% above the index returns.